Education Collections and Student Loan Debt Recovery

The CMI Group operates a highly effective and compliant agency for education collections and student loan debt recovery. With over three decades of experience, we deploy cutting-edge technology and deep data analytics to resolve balances while protecting your public image.

Relationships Matter

Our motto, "Relationships Matter," is embodied in CMI's dedication to delivering strong value and building a collaborative partnership with each of our clients. Our services cater to a wide variety of educational institutions, including:

- Four-Year Public Institutions

- Four-Year Private Institutions

- Community Colleges

- Nursing Loan Recovery

- Grad School

- Law

- MBA

- Medical

- Pharmacy

Expertise in Education Collections and Student Loan Debt Recovery

The CMI Group is well-versed in the intricacies of collections in higher education and have the expertise needed to resolve past due accounts. As experts in education collections, The CMI Group optimizes net returns, while protecting your public image in mind. We formulate a customized strategy that maximizes net back while being sensitive to your public profile. As a nationwide licensed and bonded organization, CMI provides a comprehensive array of education collection services that includes:

- Tuition Collection Agency

- Federal Student Loan Collections

- Perkins Loan Collections

- University Debt Collectors

- Miscellaneous Receivables including:

- Student Housing

- Dining and Meal Plans

- Utilities

- Parking Fines

- Library Fines

- Overpayments

- Returned Checks

- Campus Clinic Bills

Proven Strategies & Resources:

Every education institution is unique. We design strategies to meet your specific goals, objectives, and receivables management needs.

Student-Centric Solutions:

We use an empathetic and ethical approach to help former students resolve their financial challenges, providing various payment options to help fulfill their obligations with dignity. We realize the critical importance of preserving relationships with current and future alumni. We communicate with students the way they communicate starting with text messages and emails. Our mindful messaging encourages students to resume their studies and underscores the immense value and life-changing advantages a degree can offer.

Data Driven Approach

The CMI Group utilizes a multi-dimensional account scoring model that blends account attributes, consumer credit information, and interaction dispositions throughout the account's lifecycle. The scoring initiates with an evaluation of the account's age and balance, followed by incorporating the consumer's credit bureau data indicating their likelihood to pay. Based on these scores, we segment the portfolio and formulate a customized treatment strategy for each portfolio segment.

What distinguishes CMI in the collections sector is our proprietary dynamic scoring model. The secret to successful recovery lies in strategically timed communication. This model of ours continually recalibrates account scores based on various account events such as partial payments, payment plans, commitments to pay, broken promises, credit triggers like mortgage applications. CMI persistently observes, gauges, tests, and refines the portfolio strategy to ensure the highest returns.

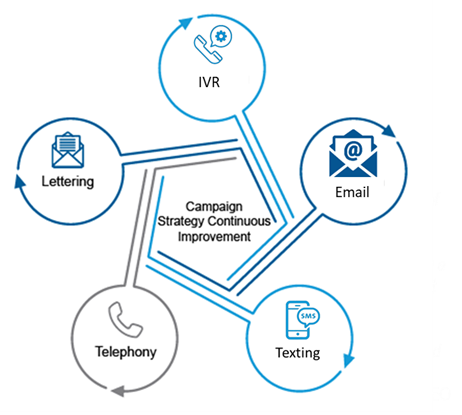

Omnichannel Outreach

The CMI Group has made a significant investment in our cutting-edge omnichannel communication suite. This technology empowers us to send and receive communication via SMS, email, traditional mail, live voice, and self-service Interactive Voice Response (IVR). This diversified approach positions us to adapt to the evolving communication preference desired by our customers and optimize payment collection. We have dedicated teams in place that expertly manage these alternative channels and deliver service excellence within each one. Our distinct position in the market is due to our integrated multi-channel strategies.

Dialing Platform

The CMI Group utilizes a dialing platform fully compliant with the TCPA. Our platform features a mix of human initiation and dialing technology that accelerates contact attempts, even to wireless numbers, while meeting strict interpretations of the TCPA. Moreover, this cloud-based system manages consent at the phone number level for each account.

Interactive Voice Response

The CMI IVR balances intuitive self-service and intelligent call routing for agent-assisted service. By leveraging this smart self-service, CMI can automate routine calls (including taking payments) while maximizing agent resources for more complex calls.

Letters

Collection letters form the bedrock of every recovery strategy. CMI tailors a series of letters for each portfolio, taking into account attributes and scoring bands. Activities related to the account, such as partial payments, payment plans, disputes, and other triggers, slot accounts into designated workflows which may include outreach via other methods. As a licensed collection agency, CMI will ensure all letters have the required components, including state and jurisdiction-specific languages and disclaimers.

Emails

CMI orchestrates email campaigns to enhance its comprehensive recovery strategy as a part of the account treatment plan. Emails are dispatched as secure messages, requiring the consumer to enter a identifier unique to them to access the content, usually a digital version of the debt verification letter. CMI receives updates on the delivery status of the email, whether it's been read, and if the secure login has been accessed. If the email bounces back, we can replace it with a paper correspondence, if the account treatment plan calls for a letter to be mailed out.

SMS Text

CMI boasts the capability, expertise, and infrastructure for consumer communication via SMS text, an integral part of our multi-channel consumer interaction approach. We employ a Human Click Initiator to send SMS text messages, ensuring our messages include necessary disclosures dictated by the consumer's jurisdiction, usually incorporated as hyperlinks. All scripting incorporated in the SMS messaging aligns with legal stipulations. To facilitate consumers in resolving their balances, we provide a dedicated SMS two-way chat, managed not by automated bots, but by actual agents.

Skip Tracing

The CMI Group leverages a unified database to integrate our skip-tracing resources. Implementing a comprehensive skip-trace waterfall strategy, we utilize multiple national database vendors to find addresses and phone numbers. Our skip-trace procedures persist for the entire duration of the account placement until the account is resolved or withdrawn. Additionally, our dialing system provides an extra layer of phone number verification. When needed, we supplement our automated procedures with manual skip-tracing methods.

Certified Compliance

As your partner, we deliver the highest degree of integrity, professionalism, and regulatory compliance. CMI has an "A+" rating with the Better Business Bureau. In addition, our certifications verify our compliance with all required data security laws, regulations, and standards, including GLBA, ISO 27002, Massachusetts 201 CMR 17.00, FTC Red Flags, Nevada Personal Information Law, and NRS 603a compliance. TECH LOCK, Inc. has certified The CMI Group for the Payment Card Industry Data Security Standard v3.2 (PCI-DSS) through their independent audit process. Additional certifications include SSAE18 SOC 1 and SOC 2 Type II and 501r-compliant and an annual Consumer Financial Protection Bureau (CFPB) readiness audit.

Let’s Connect

Choose The CMI Group for higher education debt collection and recovery. Let us turn your challenges into collections, while preserving your student relationships and institution's reputation: