Collection Agency for Banks, Credit Unions, Credit Cards and Financial Services

The CMI Group is an industry-leading collection agency for the banking and financial services industry. With over three decades of experience, we deploy cutting-edge technology and deep data analytics to maximize recovery for our clients. Our front-line specialists and management resources are well-trained and highly skilled to deliver compliant solutions. Licensed and bonded nationally, we are prepared to collaborate on customized programs that enhance financial performance while protecting hard-earned brand equity.

Our suite of services spans the life cycle of the banking customer. CMI's first-party collections program includes courtesy outreach programs for delinquent accounts and early-stage collections. Additionally, we offer traditional third-party collections initiatives spanning primary, secondary, and later-stage treatment. On each portfolio, a customized strategy is formulated based on account characteristics to maximize netback to the financial institution.

Relationships Matter

Our motto, "Relationships Matter," is embodied in CMI's dedication to building strong and collaborative partnerships with each of our clients. The CMI Group partners with numerous banking and financial sector clients nationwide. We can support the full range of financial institutions, including:

- Credit Unions

- Retail Banks

- Commercial Banks

- Credit Card Issuers

- Mortgage Lenders

- Fintech Companies

We are well-versed in the intricacies of credit extension by banks and possess the expertise required to address and resolve these matters with your clients. As experts in banking collections, The CMI Group helps you collect money while protecting your brand and preventing complaints. We formulate a customized strategy that maximizes net back while being sensitive to your public profile. Licensed and bonded nationwide, CMI has a solution for the full spectrum of banking debt account types, including:

- Auto Loan Collections

- Consumer Loans

- Mortgages

- Credit Cards

- Overdraft / Negative Shares

- Commercial Loans

Let us be your trusted partner, providing reliable, efficient, and professional collection services that enhance your financial performance and maintain your institution's reputation.

Industry Leading Technology and Analytics

Data-Driven Approach

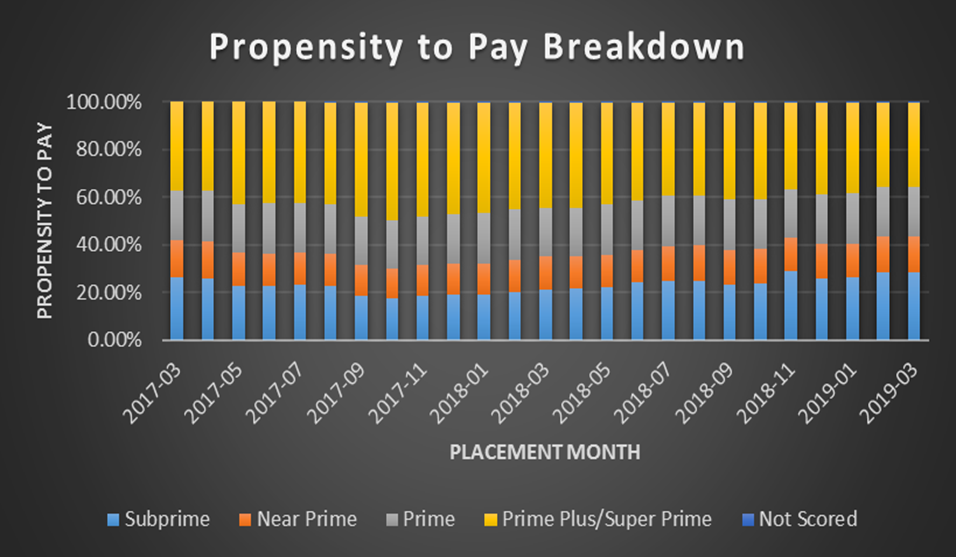

The CMI Group leverages a multi-dimensional account scoring model that blends account attributes, consumer credit data, and contact disposition data throughout the life of the account. Scoring begins with an analysis of account age and balance. Next, propensity to pay metrics from the consumer's credit bureau data are added to the equation. We segment the portfolio according to the resulting score bands and formulate a customized treatment strategy for each portfolio segment.

What makes CMI unique in the collections industry is our proprietary dynamic scoring model. The key to recovery success is well-timed outreach. Our proprietary model continues to adjust account scores throughout the life of the account based on account events (partial pay, payment plan, promise to pay, broken promise), credit event triggers (mortgage application and others), and interaction dispositions (RPC, refusal type, dispute type). CMI continually monitors, measures, tests, and refines portfolio strategy to maximize results.

Omnichannel Outreach

The CMI Group has made a significant investment in our omnichannel communication suite. Our technology allows inbound/outbound communication via SMS, email, physical mail, live voice, and self-service Interactive Voice Response (IVR). The suite positions us to meet the ever-changing channel preference desired by the customers we serve and maximize payments. We deploy specialized teams that manage these alternative channels and deliver expertise on maximizing productivity within each one. We hold a unique market position in our industry with these multi-channel interaction strategies because we seamlessly integrate these channels within one core strategy and interaction flow.

Dialing Platform

The CMI Group deploys a dialing platform that is 100% TCPA-compliant. Our platform features a mix of human initiation and dialing technology that accelerates contact attempts, even to wireless numbers, while meeting strict interpretations of the TCPA. In addition, this cloud-based system manages consent at the phone-number level within each account.

Interactive Voice Response

The CMI IVR balances intuitive self-service and intelligent call routing for agent-assisted service. By leveraging this smart self-service, CMI can automate routine calls (including taking payments) while maximizing agent resources for more complex calls.

Letters

Collection letters are a staple of any recovery campaign. CMI creates a customized letter series for each portfolio based on account attributes and score bands. Account activity such as partial payments, payment plans, disputes, and other triggers also enroll accounts into specific workflows, which may include outreach via other methods. As a licensed collection agency, CMI will ensure all letters have the required components, including state and jurisdiction-specific languages and disclaimers.

Emails

CMI manages email campaigns to complement its overall recovery strategy appropriately within the account treatment plan. The email is sent as a secure message. It requires the consumer to provide a personal identifier known only to the consumer to gain access to the message, which will usually be a digital version of the debt verification letter. CMI receives feedback on when an email is delivered, read, and whether the secure login has occurred. Additionally, if the email is bounced back, a paper correspondence can be queued as a replacement if the account treatment plan dictates a letter should be mailed.

SMS Text

CMI has the ability, experience, and infrastructure already deployed to communicate with consumers via SMS text. Text is one component of our multi-channel approach to consumer interaction. CMI utilizes a Human Click Initiator to launch SMS text messages, and our messages do contain disclosures when required by the consumer's jurisdiction. These disclosures and typically included as hyperlinks. In addition, all scripting that is part of the SMS messaging is consistent with legal requirements. We also allow the consumer to resolve their balance through a dedicated SMS two-way chat staffed not by bots but by real-life agents.

Skip Tracing

The CMI Group utilizes a centralized database to integrate our skip-tracing resources. With a comprehensive skip-trace waterfall approach, CMI leverages various national database vendors to discover updated addresses and phone numbers. Our location procedures continue for the entire account placement period until the account is resolved or withdrawn. Moreover, our dialing system offers additional phone number validation. When necessary, manual skip-tracing methods support our automated processes.

Reporting

The CMI Group prides itself on the level of analysis it provides its clients. Our reports will prove to be customizable, responsive, and anticipatory to your needs. Our library of reports and business intelligence provides essential operational and financial data to make sound business decisions. Our reports can include liquidation performance, statistical trends, and customized metrics. We are capable of providing reports on a daily, weekly, and monthly basis.

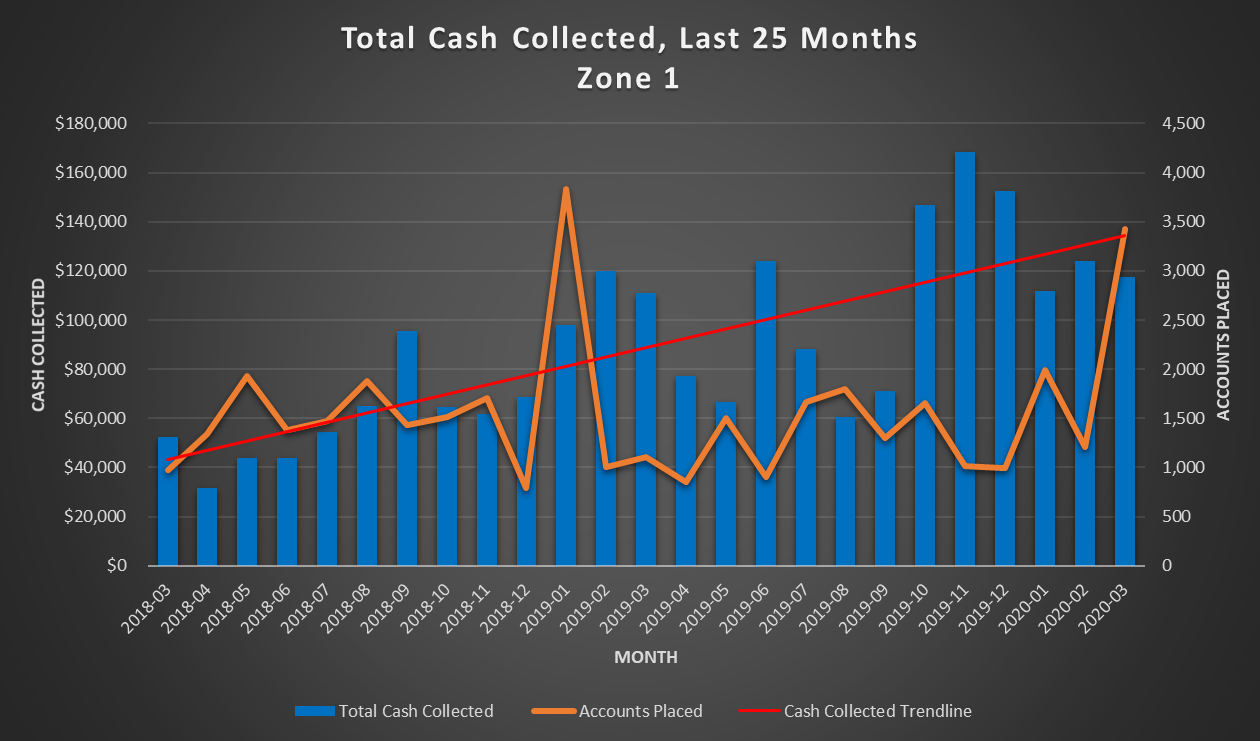

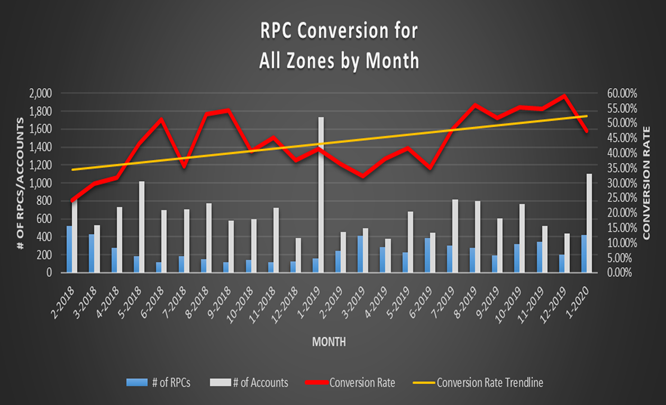

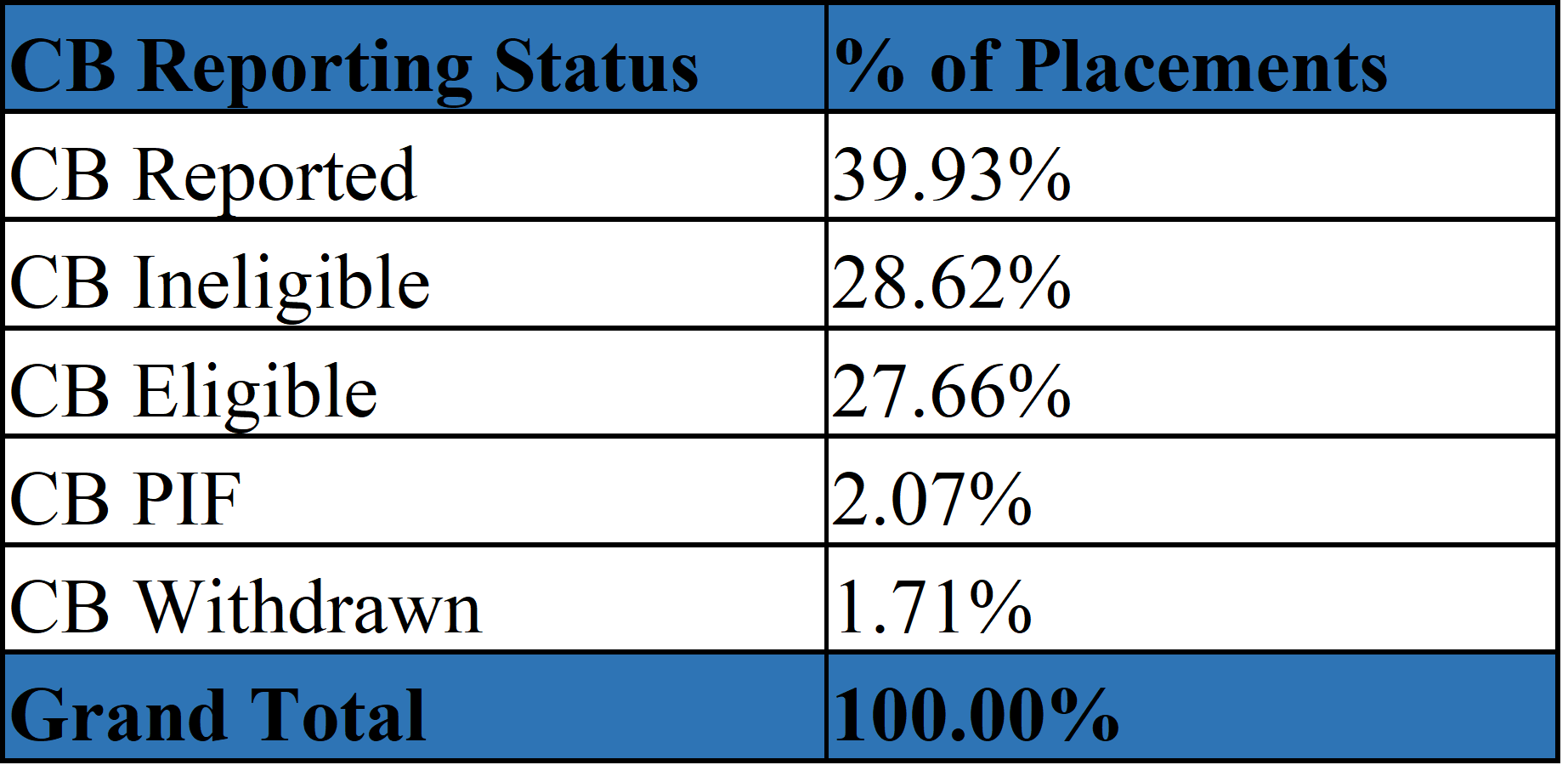

We also offer a dashboard for you to view reports on an ad hoc/self-service basis through the web portal. Reports can be individualized for separate departments as well. Below are some sample reports that demonstrate the depth of insight The CMI Group provides on our client's portfolios:

Total Cash Collected

Right Party Connect Payment Conversions

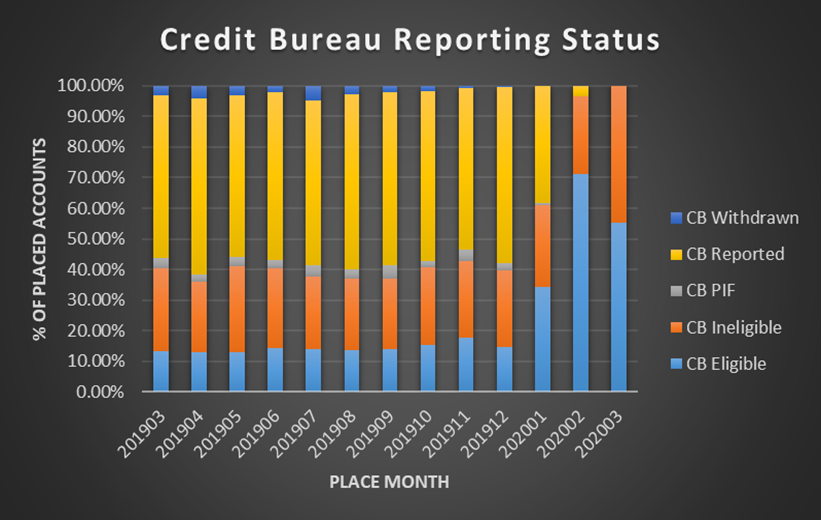

Credit Bureau Reporting Status & Eligibility Distribution

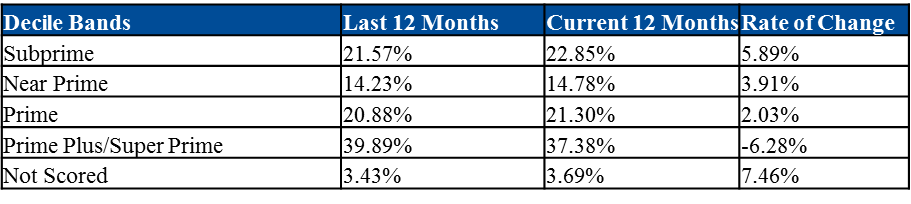

Propensity to Pay Scoring Analytics

The Competitive Edge: Our People

Collections Specialists

The quality and experience of our collectors build the foundation for our exceptional performance. We hire seasoned professionals with contact center and collections experience. Another unique differentiator of The CMI Group is our ownership structure. Our company is 100% employee-owned, which means our collection specialists share in CMI's success as they tenure with the company and gain experience. This shared investment in CMI's success creates greater pride in our services and encourages our collectors to strive for the best outcome on each call.

Our banking collections team undergoes specialized training to understand financial institutions and the products and services they offer. Additional learning is centered around one-call resolution, and each agent is coached to solve problems and resolve issues. Additionally, our collectors undergo in-depth training on relevant laws, regulations, and policies, including:

- FDCPA

- TCPA

- FCRA

- Bankruptcy Code

- ACA International's Code of Ethics

- State Collection Laws

- Consumer Financial Protection

Your Internal Advocate

The CMI Group assigns a program manager to be your primary point of contact and the constant voice of your business within our company.

Certified Compliance

As your partner, we offer the highest degree of integrity, professionalism, and regulatory compliance. CMI is an accredited member of the Better Business Bureau with an "A+" rating. In addition, our certifications verify our compliance with all required data security laws, regulations, and standards, including GLBA, ISO 27002, Massachusetts 201 CMR 17.00, FTC Red Flags, Nevada Personal Information Law, and NRS 603a compliance. Additionally, TECH LOCK, Inc. has certified The CMI Group for the Payment Card Industry Data Security Standard v3.2 (PCI-DSS) through their independent audit process. Additional certifications include SSAE18 SOC 1 and SOC 2 Type II and 501r-compliant and an annual Consumer Financial Protection Bureau (CFPB) readiness audit.

Let's Connect

If you are interested in learning more about our high-performance collection agency for banking and financial services, click below to connect with us: