First Party Collections for Banking and Financial Services

The CMI Group offers the leading first party collections program for the banking and financial services industry. Our solution was developed in response to the increased obligations that have led many customers to neglect their financial responsibilities. Regardless of whether you are a regional credit union, bank, credit card issuer, or mortgage lender, it is essential to have a solid accounts receivable strategy. Standing up a first-class recovery team is no small effort: it requires the right people, major investment in systems, and thorough compliance knowledge.

The CMI Group’s first party collections program helps your bank or financial institution resolve and prevent payment delinquency before involving a third-party collections agency. Early account resolution goes a long way to preserving customer loyalty! Calling on accounts in your name, the CMI recovery team will seamlessly extend your existing accounts receivables department- but at a fraction of the cost that it would take to self-perform the work. We are sensitive to your public profile and understand that every customer interaction is an opportunity to build your brand. Therefore, we take a softer and more diplomatic approach to account resolution.

Relationships Matter

At The CMI Group, our motto is: "Relationships Matter," and we are dedicated to building collaborative partnerships with each client so let’s work together on a solution that best fits your unique needs. We offer personalized programs with plenty of options so you end up with a scalable solution that fits in with your existing recovery strategy.

Options include:

Inbound- Handling incoming calls for payment arrangements and general billing assistance

Outbound- Strategic outreach to delinquent accounts

Omnichannel- mail, text, email, and webchat

Multilingual- Spanish and other foreign languages

Hours- Business hours, extended hours, after hours, and weekends

Location- Onshore, nearshore, offshore, and blended staffing models

Technology Leaders

Data-Driven

The CMI Group leverages a multi-dimensional account scoring model that blends account attributes, consumer credit data, and contact disposition data throughout the life of the account. Scoring begins with an analysis of account age and balance.

OMNICHANNEL Approach

The CMI Group has significantly invested in our omnichannel platform, which enables the full range of inbound and outbound communication methods. The platform supports SMS text, email, live chat, voice, and self-service Interactive Voice Response (IVR) systems. We are well-postioned to meet the ever-evolving channel preferences of the customers we serve and to drive recovery performance.

We have dedicated teams that oversee the various communication channels, providing expert guidance in each area. Our distinctive market standing in the industry comes from our ability to integrate these multiple channels into a single cohesive strategy and interaction workflow.

Dialing Platform

Many banks and financial institutions fail to equip their internal A/R teams with the correct tools to work their delinquent accounts with efficiency. The difference between manually dialing accounts and utilizing a dialing platform is night and day. CMI’s dialing platform pairs agents to connected calls and spares them from wasting time with dead numbers, non-answers, and voicemail boxes. Our platform features a mix of human initiation and accelerated dialing that meets strict interpretations of the TCPA. This cloud-based system also allows consent to be managed at the phone-number level within each account.

Speech Analytics

Many customers disregard post-call surveys, but our speech analytics tool produces customer sentiment scores directly from the phone call. With speech analytics our Quality Assurance team can scrutinize calls and pinpoint areas where our agents can benefit from coaching and training. This approach, which is centered around a scorecard-based evaluation of call quality, guarantees an optimal customer experience.

Interactive Voice Response

You likely already have an IVR in place, but The CMI Group is always at the ready to provide support or best practices upon your request. If you think it’s time for an upgrade, we can offer our IVR solution as a replacement. The CMI IVR strikes a perfect balance between user-friendly self-service and smart call routing when agent assistance is needed. By capitalizing on this advanced self-service system, CMI can automate routine calls, such as processing payments, while optimally allocating agent resources to address more difficult call requirements.

Email is a highly effective and cost-efficient outreach method for payment recovery. CMI has the expertise to craft and refine email campaigns to complement the overall recovery strategy. CMI continually sharpens the strategy with detailed analysis of each step in the payment funnel: delivery rate, open rate, read rate, click-through, and conversion rate.

As you ramp up the outreach, you should expect to receive more inbound volume than before. If you need help with the influx of payment related emails, CMI has you covered. CMI’s primary mission with email care is to preserve customer loyalty with swift, accurate, authentic, and empathetic resolution. CMI deploys brand immersed service representatives that are highly trained on your policies and procedures.

Intelligent Email Routing and Queue Management

With real-time email queue management, inbound emails are routed to appropriate agents based on skills assessments or with a familiar representative that has already interacted with the customer. Conversations can take place in a combination of universal, team-based as well as personal email queues.

SMS Text

Numerous aspects contribute to the effectiveness of SMS text outreach, but the chief of all is that text messages get read. According to Pew Research, 97 percent of Americans now own a cellphone of some kind. In fact, their polling indicated 100 percent of adults aged 18-49 had a cell phone and historically our open rates have exceeded 95%!

SMS Outreach

CMI has the experience and infrastructure in place to meet your customers in their preferred communication channel. Most often we adopt a drip outreach approach with a series of texts over a couple of weeks with messages that grow in urgency. Messages typically drive payments through your exitsting online payment gateway, but we also have the flexibility to direct customers to talk to an agent when a payment arrangement would be better suited for account resolution. All scripting that is part of the SMS messaging is consistent with legal requirements.

Two-Way SMS

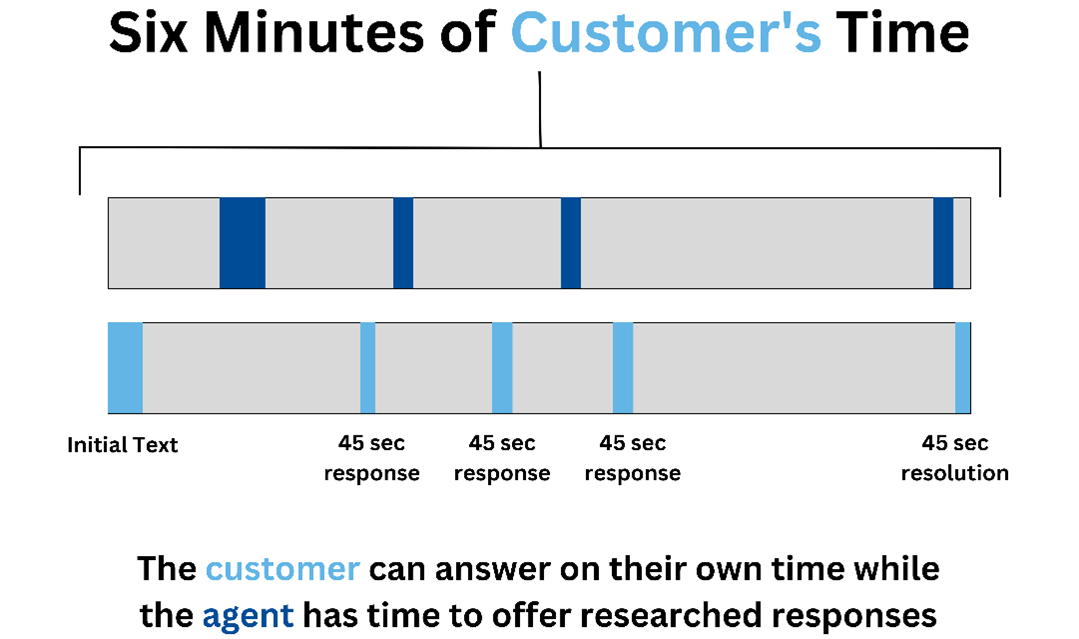

To offer additional convenience to your customers, The CMI Group can set up two-way SMS. Customers can resolve their balances through a dedicated SMS two-way chat staffed by real-life agents. Referencing pre-defined content tailored to be consistent with your branding, we guide customers to initiate a payment via a PCI-compliant form and resolve their account without a phone call. Just as with email and web chats, our SMS messaging can utilize predefined content to ensure messages are consistent and in line with your brand and your desired scripting. The graphic below gives a visual illustration of the convenience afforded to the customer when they are free to engage on their own time:

Live Chat

The CMI Group makes it easy to embed a web chat function on your existing website, and the web chat interface can be branded to match your site’s look and feel. Webchats can be made available across your entire site or only specific pages.

Our web chat is simple to configure and helps you avoid the traditional integration hurdles needed to drive an effective webchat strategy. We seamlessly link website visitors with agents and self-service chatbots. Like all contact channels, a web chat must be highly personalized to be fully effective. Webchat personalization requires deep integrations with existing systems and applications that can be costly and time-consuming. CMI leverages LiveVox’s native CRM to solve these challenges by fully integrating all channels with existing systems so there’s no need for lengthy implementation or software redundancy.

In short, our live chat platform also provides the following:

- Ability to create ongoing connections with your customers through their desired form of communication

- Ability to manage multiple, concurrent customer conversations

- Access to a library of proven predefined messaging consistent with your brand

- Verification scripting ensures right-party validation before the release of any account information

- Track performance in real-time

Cross-Channel Interaction History and Personalization

All interaction channels are connected to our unified customer database. The platform stores and attaches all conversations, regardless of the channel of origin (email, phone, SMS, and live chat), to the customer profile. This cross-channel interaction history makes it possible for agents to provide accurate personalized responses and seamlessly escalate interactions. The centralized dashboard provides insight on the entire consumer journey. The platform also tracks customer channel preferences, allowing them to designate the most appropriate method of communication.

Extended Hours

The evening and weekend hours can be the most productive time for recovery efforts. Extended hour availability and outreach meets your customers after their busy workday in the privacy of their own homes at a time of convenience.

The Competitive Edge: Our People

We know service excellence is essential in any customer facing function, and our first party collection programs balance the importance of account resolution with a positive experience. A key component in our success is the quality and experience of our customer support representatives. CMI is 100% employee-owned, and our front-line representatives share in CMI’s success as they tenure with the company and gain experience. This shared investment in CMI’s success creates greater pride in our services and encourages our agents to strive for the best outcome on each call.

Let's Connect

If you are interested in learning more about our first party collections program for banks and financial institutions, click below to connect with us: